How do you calculate Return on Investment (ROI)?

The topic could be its own post. For this discussion, we want to give an overview of a quick way to measure the ROI that would result from having a property manager oversee the operations of your rented properties versus Doing-It-Yourself (DIY).

The goal is to maximize the ROI and to identify what elements (features and facts) are important to the property manager. The property manager can be the homeowner renting out their home. Or it could be a property management firm handling the activities needed to make the rental (and the investment) profitable.

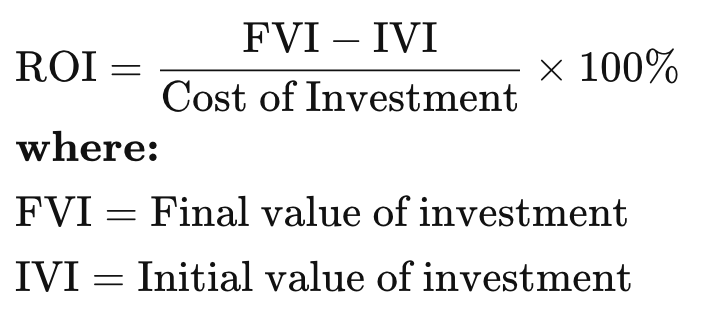

Simply put, ROI is an attempt to quantify how much money an

investment made (or will make) relative to its cost, expressed as a percentage.

To answer the question of whether DIY is preferable to hiring a Property Management firm, such as CREM Management, the crux of the calculation is correctly identifying your costs—because after all is said and done:

The initial value and the final value are determined by the purchase price and the (future) sales price of the asset.

Many of the costs are recognized from receipts, but others are a little more difficult to pin down. For instance, the opportunity cost of doing something else with your time is hard to quantify.

Assigning a cost to the risks inherent in rental properties is tricky. How much insurance should you carry? What’s the neighborhood really like?

It is easy to underestimate some of the headaches and problems of being a landlord.

It might be easier to invest in stocks and bonds.

For a discussion of the kinds of things a landlord needs to do and

what property managers do for you, please see this post.

After checking to see what is involved in being a property owner who rents out spaces of various kinds, some of the costs can be entered in the formula below.

What Numbers Do You Plug in Your Formula?

Investopedia takes a deep dive into ROI. We give them credit for a formula that can be used for an estimate but suggest reading their entire post and then some more by different resources, such as this Forbes Magazine article titled, What Is Real Estate Return On Investment (ROI)?

The simple formula does not take the amount of time over which the investment is held, which is very important for real estate. However, the principle is the same. The Forbes article states that for rental properties:

“To calculate the ROI for a rental property, first estimate the annual rental income and annual operating expenses, which would include the costs of maintenance, property taxes, utilities, and other ongoing costs. Most rental properties are financed. Assuming this, the ROI is calculated by subtracting annual rental income from annual operating costs and dividing by the balance on the mortgage loan.” Source: Forbes

If the final percentage figure is positive, the investment has made (or will make) money for the investor. If the investment cost (the denominator) is too high, then the % ROI is small. Using the answer to the ROI by varying costs and estimating the final value will yield a method to compare one property to another. It will also help evaluate the ROI of managing the property yourself (DIY) or hiring a property management company to do the job.

What Is the Biggest Mistake People Make?

The biggest mistake is undervaluing the cost of their time. The second biggest is not understanding the nature of the risks in real estate investing. Because the third is overvaluing rental income.

Undervaluing Their Time

When someone is just starting to rent out their property, they may have a day job. That’s 40++ hours a week. How much do they take home from that job? How much time do they have left over? What they pay themselves to manage their property should at least equal what they make at their day job. They usually don’t “pay” themselves anything.

Then there’s underestimating the time they spend on the rental. “It’s only a few hours,” they say. Then the plumbing breaks, or the refrigerator dies. Can they fix it or do they have to hire a plumber who makes three times their hourly rate? How long does it take to do each of the tasks required to be a good and profitable landlord? These hidden costs make some newbies happy with the ROI on their home rental, but is it real? They “forget” to add in the costs to market it, paint it, clean it during turnovers, ad nauseum. Then they fail to consider that weekends should be family-and-friends time: spouse, kids, parents, in-laws, neighbors. Does the typical do-it-yourselfer put a price on those hours lost to the property? It’s hard. ROIs for single-unit rentals are often inflated because some of the costs (in the denominator of the equation) are buried.

Undervaluing Risk

One of the biggest risks in rentals is not fire or damage. It’s “sketchy” tenants. Finding good tenants is not cut and dried. It’s an art form attached to the carefully crafted steps to achieve the “Goldilocks” of renters. It’s challenging to find just-right tenants who are not too noisy, not too demanding, and they pay on time! Getting uncooperative tenants out of a property is sometimes difficult, even for the pros. CREM Management is owned by an attorney, making tenant removal easier.

What other risks are there? Vacancies make the ROI zero or even negative. Fires, earthquakes, floods, and pandemics have also stopped many investors in their tracks. Real estate investing is like investing in stocks. It’s best left to the professionals, who can’t stem the floods but can reduce the risks of bankruptcy.

Overvaluing the Rent Income

Do you know what figures to plug into the formula above? Even if you did, do you know how to run the figures through the formula and try to guess the ending value of your property? When will that be? Are you planning on keeping the property for ten years or twenty? Or one? How sure can you be the rents you charge will cover the expenses of owning the property? How competitive are you? In short, how much rent can you get for your property? How can you find out?

Seasoned landlords may be able to figure this out, but people who are just starting or people who are investing in new or distant geographies don’t always have the computer power or know-how to crunch these numbers. Nowadays, it pays to make data-informed decisions about rental properties.

The bottom line is that you can 1) invest and manage investment property yourself, 2) have a property management company do it for you, or 3) decide that the stock market is safer. Either way, it’s wise to research with property management companies’ help before you invest. Here’s what you can expect from their services:

Get Optimized Rental Value for Your Property

Gain Crucial Insight into Current Market Conditions

Determine Your Cashflow from Monthly Rental Value

How Much Does Property Management Cost?

The fees can vary. Some ranges are 6 to 10% of the monthly rental rate, while others range from 8 to 12% of the collected rent. When the final price is set, it depends on many factors. Where is the property? How old is it? How many property management services will be completed by the property manager? How many units need to be managed? Who will do the repairs and upkeep, how are rents collected, etc.?

TO EVALUATE ROI for PROPERTY MANAGEMENT vs. DO IT YOURSELFAdd 10% (halfway between 8 and 12%) to the cost part (denominator) in the equation above.Consider that the rental income (in the numerator) may be higher with professionals finding tenants for you and running a tighter, cleaner ship with fewer vacancies and lower turnover. |

CONCLUSION

Real estate investment can involve owning a home and renting it out or owning a shopping mall—or two—or twelve. Real estate, as an asset class, forms part of the infrastructure of the world economy. Warehouses, manufacturing plants, retail stores, and office buildings comprise the commercial real estate markets from which investors make or lose money every day.

Depending on the size of the real estate portfolio and its owners, they sometimes have people inside who can “DIY.” However a vast swath of landlords at the low and even the high ends can use property management companies to lower the hassle factor and increase the ROI. It’s worth it to have an evaluation of your property to decide if the expected ROI meets your investment needs. It requires someone with the means and expertise to estimate the revenue and costs with and without a property management company’s help, guidance, and expertise.

It is rare to find companies with a CPA and an attorney owner in the mid-range property management space. CREM Management is one of those.

For questions about your property, please get in touch with us here.

For your convenience, we have included some of the property management services performed by CREM Management.

Online/Secured Rent Collection & Payments

Our online rent collection and payment platform allows for immediate and secured rental collection and payment allocation.

Comprehensive Financial Management

With CPAs on staff, CREM Management white gloves all financial management

including bill payments, bank reconciliation, profit distribution & operational analysis/forecasting.

Online 24/7 Maintenance Portal & Processing

Assuring that each and every maintenance request is received, processed, and dispatched for efficient completion.

Vetted Vendor Partners

Advantageous pricing on any ancillary maintenance.

24/7 Owner Access

The owner portal allows 24/7 access to financials, maintenance reports, monthly status updates, insurance docs, entity ownership documents, and any other documents related to the property.

Bespoke Rental Marketing

Strategic, professional, and targeted, our proprietary marketing campaign ensures that any vacancies are filled in a limited time for the highest market rate. Each unit is marketed using professional photography and video.

10-Point Tenant Screening

This includes credit reports, criminal background checks, landlord, residence and eviction history, income and employment verification, judgment, lien, and bankruptcy history, and a host of others.

Unit Turnover

Time is money; we pride ourselves on a quick, diligent, and efficient turnover. With in-house counsel, our lease documents are comprehensive and compliant and limit liability at every term.

Eviction Counseling

Unlike other Property Management companies, CREM Management is entirely attorney-owned. With such legal acumen, eviction processing is done in-house, quickly, efficiently, and within budget.

Construction Oversight

Experienced oversight matters. CREM Management provides owners with expert project oversight for value-add projects from 1 to 100 units, ensuring a smooth completion.

For questions about these services or your property’s specific needs, please contact us here.